You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

WTB SCAMMER

- Thread starter TWG0572

- Start date

How any people are going to still accept G&S, knowing they'll have to pay taxes on it?Only pay with G&S and you're insured. 3.49% for peace of mind isn't a bad deal.

Wyobohunter

WKR

- Joined

- Dec 23, 2021

- Messages

- 1,583

Hopefully he didn’t use my pics to sell it to you. I sold one to another rokslider very recently.I bought a Helinox chair from him guess I’ll find out

Sent from my iPhone using Tapatalk

Wyobohunter

WKR

- Joined

- Dec 23, 2021

- Messages

- 1,583

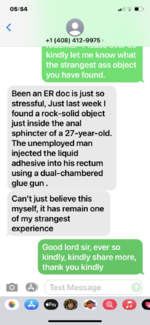

WTF is the deal with “kindly”? Why would that be a

marksman1941

WKR

- Joined

- Oct 11, 2021

- Messages

- 399

It tends to be used by non native English speakers when they're trying to sound friendly. It's almost ubiquitously linked to scams.WTF is the deal with “kindly”? Why would that be a

Wyobohunter

WKR

- Joined

- Dec 23, 2021

- Messages

- 1,583

antelopedundee

WKR

- Joined

- Nov 24, 2020

- Messages

- 317

Only if you can document your cost and then you pay taxes on the gains. If you sell it for less than you paid which many do for a used item then document that too because that loss can be used to offset gains. Of course it matters only if your return is audited. You're more likely to get a second look if your 1099-Ks are for $50K instead of $4K.How any people are going to still accept G&S, knowing they'll have to pay taxes on it?

“Kindly” is ALWAYS a dead give away.

Sent from my iPhone using Tapatalk

I agree. I bought a rifle from here and the guy typed "kindly" somewhere on the private message. I immediately asked him to call me. It turned out he was a stand up guy and we had a laugh about it. I got the rifle and everything worked out.

Fwiw, I always check the sellers previous posts. In fact, that's how I ran across this thread while buying a scope today. The seller posted in here and now I'm bumping this thread.

- Banned

- #54

Not a bad plan to check their previous posts, etc, but “well known roksliders” accounts are getting hacked.

Sent from my iPhone using Tapatalk

A

Not a bad plan to check their previous posts, etc, but “well known roksliders” accounts are getting hacked.

Sent from my iPhone using Tapatalk

I agree. As previous posters said, the phone call does the trick when in doubt.

- Banned

- #56

My suggestion is to ask for something that can't be easily photoshopped. For example, a 'selfie' of the seller holding the item in front of the TV with a channel specified by you on in the background. Easy enough for a credible seller to do, but not so easy to scam.

antelopedundee

WKR

- Joined

- Nov 24, 2020

- Messages

- 317

Make it YOUR policy that the person offering the item/deal ship first. If they won't then fuhgeddaboutit.

- Banned

- #59

How many have taxable gains on used equipment?How any people are going to still accept G&S, knowing they'll have to pay taxes on it?

antelopedundee

WKR

- Joined

- Nov 24, 2020

- Messages

- 317

If you can't document your cost/basis you'll need to declare 100% of the proceeds as taxable or just fib and hope you don't get audited.How many have taxable gains on used equipment?

BTW it doesn't matter if it's G & S or PPFF as BOTH will get reported on the 1099-K.

Similar threads

- Replies

- 14

- Views

- 2K

Featured Video

Stats

Latest Articles

-

The Intersection of Hunting Big Mule Deer & Big Whitetail

-

YETI LoadOut GoBox Review

-

Big Bucks, Bigger Secrets: Antelope Island Unguided

-

Iron Will Wide Single Bevel Broadhead Review

-

TT#43 Travis Hobbs Alaskan Brown Bear Hunt

-

YETI Tundra 210 Cooler Review

-

Rifles for Hunting Big Mule Deer

-

T&K Gen 3.1 Bino Harness Review

-

Seek Outside Twilight 3P Tent Review

-

Montana Knife Company Culinary Set Review