Technically yes...haha like that will happen...What is going to happen is people making a little extra on the side are going to get dinged for more taxes and thieves will thieve. Hopefully whoever gets in office next immediately reverses this B.S.Do you have to declare profits from looting during BLM riots?

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Don’t forget to report your classified sales to the IRS!

- Thread starter Ucsdryder

- Start date

antelopedundee

Lil-Rokslider

- Joined

- Nov 24, 2020

- Messages

- 290

An acquaintance friend tells me that the IRS doesn't even get around to matching 1099s with returns until some time in the summer. I filed using TurboTax last summer and missed reporting some income. Neither the IRS nor my state revenue dept caught it, yet.This was already the case in IL last year. I got 1099s from ebay, facebook marketplace, and paypal. I think I had 10k or so in income but profits were probably only a few hundred bucks. My accountant had me get pretty close and that was that. I might start keeping track of sales in a little spreadsheet going forward just for good measure. That being said, the IRS trying to keep track of this sounds like a complete joke. What % of the population sells stuff online? It has to be a rather large number.

antelopedundee

Lil-Rokslider

- Joined

- Nov 24, 2020

- Messages

- 290

IIRC PayPal currently does not report PPFF payments tho that likely will change.Luckily 2021 transactions are not subject to this, it kicks in 1/1/2022.

This is timely, PayPal was just asking for my SSN. **** that.

antelopedundee

Lil-Rokslider

- Joined

- Nov 24, 2020

- Messages

- 290

If you do it in a business sense and accept Venmo, PP or other cash App it would make sense to have a separate bank account to which funds are received and from which purchases are made.

ETtikka

WKR

Are we gonna have to start mailing personal checks or money order instead of pp Venmo etc

antelopedundee

Lil-Rokslider

- Joined

- Nov 24, 2020

- Messages

- 290

If the seller will take them. Also the seller still has to report them. I don't know if there was an audit if it would show that the buyer cashed the check at his or possibly your bank instead of depositing it. Of course your bank won't dole out the cash to you unless you have enough in your account to cover it.Are we gonna have to start mailing personal checks or money order instead of pp Venmo etc

Broomd

WKR

Complete lunacy. Time for money orders, checks, and good ole cash, guys. I'm not using PP over the $600 threshold. If that's a deal breaker with some guys moving forward with my buying and selling so be it. Then no deal.

Screw them and the Brandon horse they rode in on.

Screw them and the Brandon horse they rode in on.

antelopedundee

Lil-Rokslider

- Joined

- Nov 24, 2020

- Messages

- 290

I doubt the IRS expects anyone to have a receipt for or document the cost of that box of bullets you bought 5 years ago. Of course if you're operating as a business you probably have most or all of that info. What about the shop that has stale old stuff that's sat there for years. How do they handle it?Complete lunacy. Time for money orders, checks, and good ole cash, guys. I'm not using PP over the $600 threshold. If that's a deal breaker with some guys moving forward with my buying and selling so be it. Then no deal.

Screw them and the Brandon horse they rode in on.

Htm84

WKR

- Joined

- Jun 16, 2019

- Messages

- 348

Actually yes you do. Before you ask you need to declare bribes as well.Do you have to declare profits from looting during BLM riots?

This should get the country back on track.

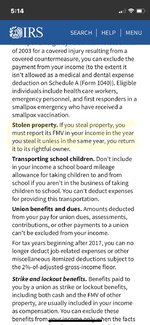

Attachments

Broomd

WKR

If it is sold after 1/1/22, you had better have documentation, regardless of when the product was originally purchased. That's one of the ridiclous facets of this, the burden is on us to PROVE it isn't a profitable transaction. Brandon's BBB bullsh t bill calls for the hiring of another 87000 IRS agents. Hint: they aren't auditing Progressives or the likes of BIll Clinton!I doubt the IRS expects anyone to have a receipt for or document the cost of that box of bullets you bought 5 years ago. Of course if you're operating as a business you probably have most or all of that info. What about the shop that has stale old stuff that's sat there for years. How do they handle it?

- Banned

- #31

That's how I've paid for 99% of the gear I've bought on the Classifieds here.Are we gonna have to start mailing personal checks or money order instead of pp Venmo etc

I don't do PayPal or Venmo unless it's absolutely necessary.

antelopedundee

Lil-Rokslider

- Joined

- Nov 24, 2020

- Messages

- 290

PP or Venmo is damn handy when time is of the essence. I doubt that I could have guaranteed a scope would be available to deliver if I had to wait and futz with snailmail payments, plus the risk of rubber checks.That's how I've paid for 99% of the gear I've bought on the Classifieds here.

I don't do PayPal or Venmo unless it's absolutely necessary.

Silveroddo

WKR

- Joined

- Apr 13, 2019

- Messages

- 487

Thats my issue with it, I'd venture to say the majority of the people this affects aren't in a situation where the items they're selling were purchased with the intent to profit. Say I sell the electronics from my boat to upgrade, WTF's it to them? Is the next thing auditing garage sales? Meanwhile Hunter Biden can he an "artist" and Nancy Pelosi can "participate in the free market" with impunity. There's another big thread about this from when it was initially announced.While it's true most sales are at a loss, you still need the receipt showing the original purchase price to support the loss. That's going to be the biggest pain.

Silveroddo

WKR

- Joined

- Apr 13, 2019

- Messages

- 487

Until it isn't, I think the writing is on the wall as to what the intention of all of this is in the long run. You can't even dismiss it as tinfoil hat anymore.Cash is king boys!

antelopedundee

Lil-Rokslider

- Joined

- Nov 24, 2020

- Messages

- 290

They are so far behind that even with 87,000 new auditors it will take them years to catch up. There's way bigger fish to catch.

- Banned

- #38

Ask Al Capone how new this is…Go to jail for not paying taxes on stolen goods. Don't go to jail for stealing goods. Welcome to the new Amerika.

Let's go Brandon!

Lol, true!Ask Al Capone how new this is…

You will not be getting a 1099 like a contractor, it’ll be a 1099-k.

As explained by Forbes:

“ Form 1099-K is a tax form sent to users that may include both taxable and nontaxable income sources. A taxable source of income is included in your income, such as wages, rents, tips, and retirement income. Whereas a nontaxable source is excluded from your income and you will not need to report on your tax return.

Some examples of nontaxable income are:

Money received from a friend as a reimbursement

Money received from a roommate to pay their share of the rent

Money received from a loved one as a gift

Also, if you receive money from selling a personal item at a loss, you are not required to report the amount on your tax return. For example, if you purchased a dress for $100 and sold it for $50, the amount is not taxable.”

So don’t get too chicken little....

As explained by Forbes:

“ Form 1099-K is a tax form sent to users that may include both taxable and nontaxable income sources. A taxable source of income is included in your income, such as wages, rents, tips, and retirement income. Whereas a nontaxable source is excluded from your income and you will not need to report on your tax return.

Some examples of nontaxable income are:

Money received from a friend as a reimbursement

Money received from a roommate to pay their share of the rent

Money received from a loved one as a gift

Also, if you receive money from selling a personal item at a loss, you are not required to report the amount on your tax return. For example, if you purchased a dress for $100 and sold it for $50, the amount is not taxable.”

So don’t get too chicken little....

Similar threads

Featured Video

Stats

Latest Articles

-

TT#28 Idaho Bear Hunting with Roger Holscher and Chris Young

-

Rockstar Research with Kevin Monteith

-

Hunting Big Mule Deer: Obey the Wind & Still-Hunting

-

TT#27 DIY New Zealand Hunting with Australian Duo Miller and Pitts

-

Fewer Bucks, More Fawns?

-

Mathews Lift Review

-

Wyoming Range Winter Wrap-Up with Jeff Short

-

The Pursuit with Cliff Gray

-

Mile High Mule Deer Seminar

-

TT#26 Kyle Virgin and the infamous Hobbit Rifle